January 4, 2023 | Andersen Group Realty

2023 NATIONAL MARKET OUTLOOK

As a result of fast-rising mortgage rates, the second half of the 2022 real estate market saw a slowdown from the historical growth experienced since the pandemic. As we enter 2023, mortgage rates are expected to decline slightly, which will help to increase affordability for home buyers. That being said, lower levels of demand and a resetting of price expectations for homeowners, are expected to result in a more balanced and slower market in 2023.

As displayed below, we expect home sale prices to remain steady or even increase slightly in 2023. However, the overall level of sales activity will decrease significantly as both buyers and sellers work to adjust to the new reality of the real estate market after the frenetic conditions that existed for the past two-and-a-half years.

Despite the recent shift in the real estate market, we still remain in the seller’s market that has persisted for nearly the past decade. While many people speculate about whether or not we’re on the verge of another event like what happened in 2008, we are in a drastically different environment than the conditions that existed leading into that decline. As you can see in this chart, there is still a lack in inventory and the pent up buyer demand from the past several years continues to fuel a market where sellers are receiving historically high prices for their home. In 2023, we expect that the market will continue to become more balanced and continue to shift towards a more neutral market as inventory continues to increase.

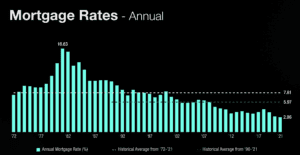

While historically low interest rates fueled historically high home sale prices over the past two years, both mortgage rates and home appreciation rates have returned to more normal and sustainable levels through the 2nd half of 2022. Current interest rates are right in line with the historic average from the past 30 years and have been steadily declining after peaking in late October. These dropping interest rates combined with more inventory and less competition, make it an opportune time to buy a home this winter before the competition is expected to pick up in the Spring. Interest rates are projected to slowly decrease in 2023, however they are unlikely to return to the historically low levels that we saw over the past few years.

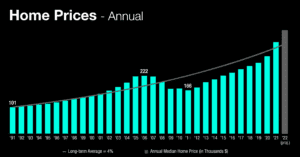

Home sale prices in the past two years increased at a higher rate than ever before, and well above the long term average of 4%. While home sales prices are expected to level off in 2023, home sale prices are expected to slow down, not necessarily go down. Appreciation rates will likely be much closer to the long term average as the market continues to become more balanced. As this shift takes place, it is more important than ever for sellers to be smart about the pricing of their home. By pricing a home based on the market that we are heading into, rather than the market we’re coming out of, seller’s will still be able to capitalize on all of the equity that has been gained in the past few years.

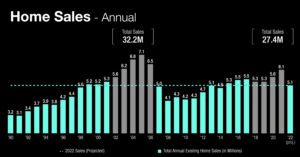

Existing-home sales, which fell throughout 2022 as mortgage rates surged due to the Federal Reserve’s efforts to hike interest rates to control inflation, are projected to slide by another 6.8% to 4.78 million in 2023, according to Lawrence Yun, NAR’s chief economist. This would result in the lowest annual total of home sales since 2012, when the housing market was still in a slow recovery from the subprime mortgage crisis. Higher mortgage rates are expected to cause some prospective home buyers to put their search on hold, however pent up demand and motivated buyers will keep the number of sales locally from declining as much in some other markets throughout the country. Despite the projected decline in home sales, the National Association of Realtors still expects home sale prices to hold steady. In more competitive markets such as the Greater Boston area, the sales prices are likely to appreciate, albeit at a much lower rate than the past few years.

*Data and statistics are sourced from NAR