March 5, 2023 | General

2023 Real Estate Market Outlook

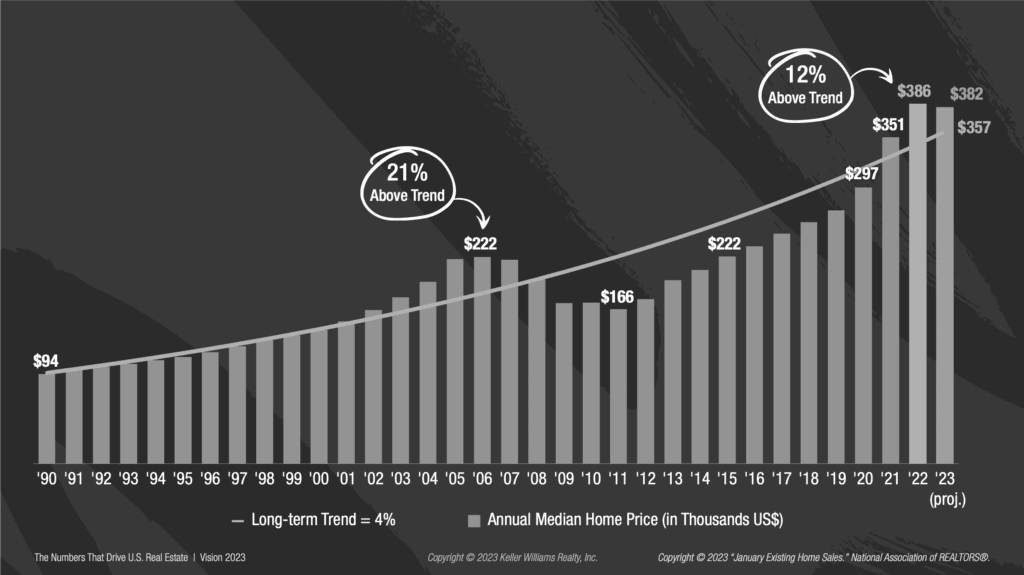

Annual Home Prices

Over the past few years, the rate of home price appreciation has been well above the historical trend line of 4%. This can be attributed to a variety of factors such as low mortgage rates, increased demand for housing, and limited inventory. While there is a projected dip in home prices nationally in 2023, the rate of appreciation is still expected to remain above the historical trend line.

Homes in the Greater Boston area have experienced significantly higher rates of appreciation than the national average over the past few years due to a variety of factors such as the city’s strong economy, highly-regarded educational institutions, and desirable quality of life.

Despite a dip in home prices nationally projected in 2023, the Greater Boston area is still seeing an extremely active real estate market due to the low levels of inventory at the start of the year. We’re commonly seeing multiple bid situations reminiscent of the past few years, as buyers compete for a limited available properties. This high demand for homes in the Greater Boston area is expected to continue, which could aid in keeping local home sale prices steady in 2023.

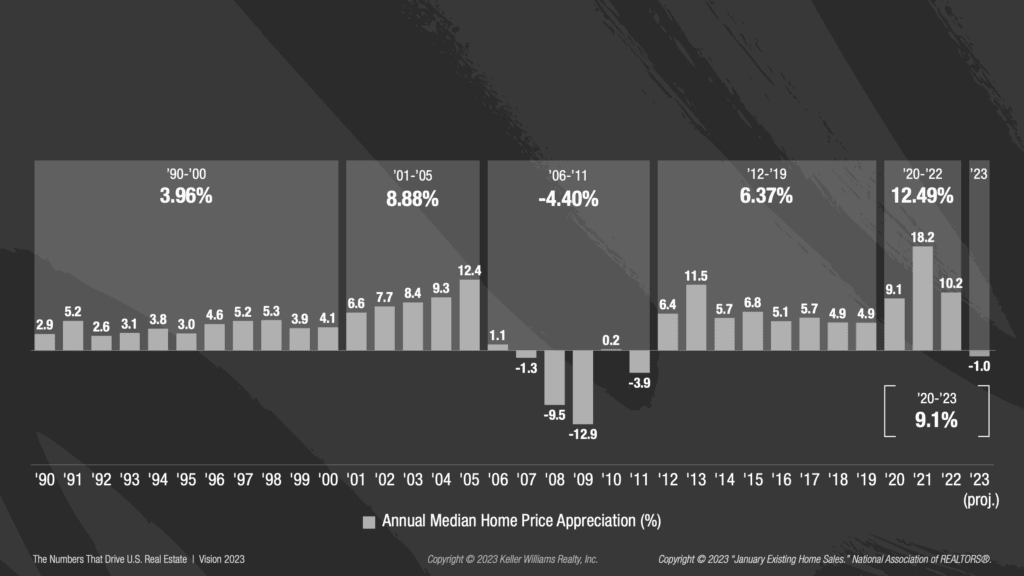

Annual Home Price Appreciation

Despite a potential dip in appreciation nationally in 2023, the average rate of appreciation across the country is expected to remain over 9% since the start of the pandemic. This means that homeowners are still in a tremendous equity position and motivated sellers can still capitalize on this historically high rate of appreciation by selling their homes for a profit or leveraging their equity for other financial purposes.

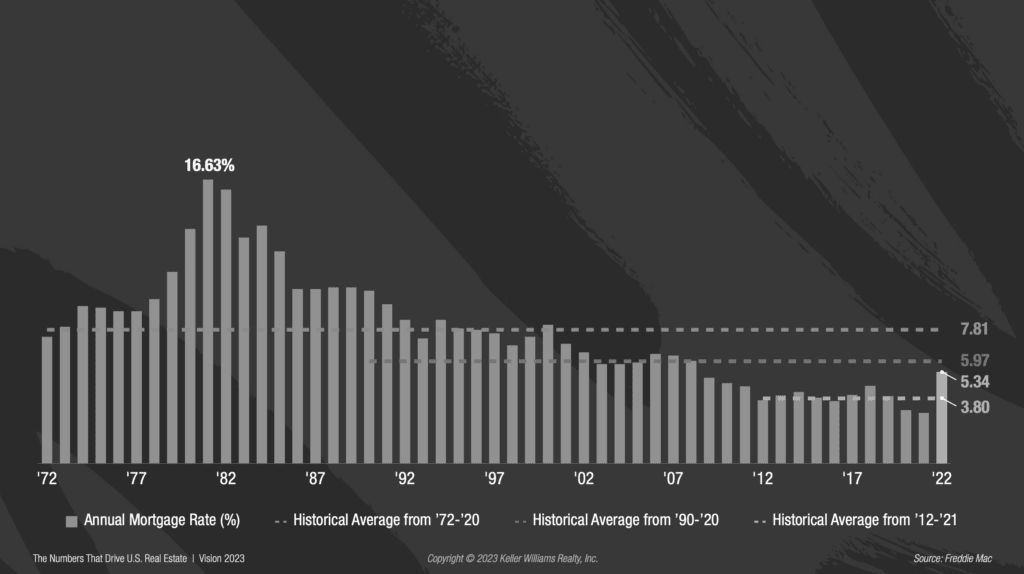

Annual Mortgage Rates

The drastic increase in interest rates in 2022, as a result of the Fed trying to get inflation under control, slowed down the real estate market significantly in the second half of the year. Higher interest rates led to increased borrowing costs, which reduced affordability and decreased demand for homes. However, in 2023, buyers are starting to come to grips with the new reality of the market.

While interest rates are higher than they were a few years ago, they are still competitive when looking at it from a historical perspective, with the average for the past 30 years being 5.97%. As a result, many buyers are recognizing that they still have the opportunity to lock in relatively low mortgage rates and are re-entering the market. This increased demand, combined with limited inventory, is leading to multiple bid situations and increased competition among buyers.

If you have any other questions about pricing or where the market’s going, or just have general questions, please don’t hesitate to reach out as we’d be honored to help.