July 31, 2025 | Uncategorized

Real Estate Market Update

The 2025 real estate market across Winchester, Lexington, and Arlington reflected a steady continuation of strong pricing amid a more normalized pace of sales activity. While transaction volumes held below peak pandemic levels and inventory expanded modestly, home values remained elevated, with average sale prices and price per square foot maintaining or building upon the gains recorded in recent years. Buyer demand remained healthy throughout the core spring and fall selling seasons, with competitively priced and well-prepared homes often attracting multiple interested parties. Days on market remained relatively efficient across the three towns, particularly in Arlington and Lexington, where updated homes in desirable neighborhoods continued to move quickly. Overall, 2025 reinforced the tri-town corridor’s positioning as one of Greater Boston’s most sought-after residential pockets—defined by strong buyer engagement, resilient pricing, and enduring market confidence despite broader shifts toward a more balanced housing environment.

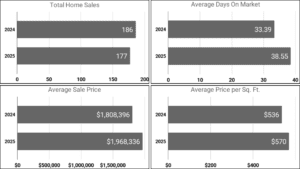

Winchester

Winchester’s 2025 real estate market reflected a shift toward higher pricing amid slower sales activity. Total home sales declined by 4.8%, falling from 186 in 2024 to 177 in 2025, signaling reduced transaction volume and continued inventory constraints. Despite fewer sales, pricing strengthened meaningfully, with the average sale price rising 8.9% from $1,808,396 to $1,968,336, and the average price per square foot increasing 6.3% from $536 to $570, indicating sustained buyer demand for premium properties. Marketing times lengthened modestly, as average days on market increased 15.5% from 33.39 to 38.55 days, though well-prepared and competitively priced homes continued to draw interest and sell efficiently. Overall, Winchester’s 2025 market favored sellers, with limited supply contributing to elevated pricing in an otherwise more measured selling environment.

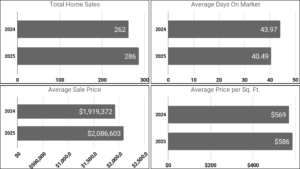

Lexington

Meanwhile, Lexington’s housing market in 2025 demonstrated both strength and efficiency, highlighted by rising prices and faster sales. Total home sales increased by 9.2%, rising from 262 in 2024 to 286 in 2025, reflecting steady buyer activity despite ongoing inventory constraints. Pricing continued to trend upward, with the average sale price climbing 8.7% from $1,919,372 to $2,086,603, while the average price per square foot increased 3.0% from $569 to $586, underscoring sustained demand for Lexington’s high-value homes. Notably, marketing timelines improved, as the average days on market fell 7.9%, decreasing from 43.97 days to 40.49 days, signaling quicker decision-making and continued buyer competition. Overall, Lexington’s 2025 market was defined by premium pricing, healthy transaction volume, and strong buyer confidence.

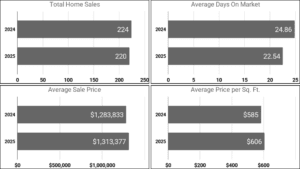

Arlington

Finally, Arlington’s real estate market remained competitive in 2025, pairing steady price growth with faster sales activity. Total home sales declined 1.8%, from 224 in 2024 to 220 in 2025, indicating slightly tighter available inventory for buyers. Despite the modest dip in volume, pricing strengthened, with the average sale price increasing 2.3% from $1,283,833 to $1,313,377, and the average price per square foot rising 3.6% from $585 to $606, signaling continued willingness among buyers to pay premiums for updated and well-located homes. Marketing timelines improved as well, with the average days on market decreasing 9.3% from 24.86 to 22.54 days, underscoring sustained buyer demand and a quick-moving housing environment. Overall, Arlington’s 2025 market maintained upward pricing momentum, supported by limited supply and consistent buyer confidence.

In summary, the 2025 real estate market in Winchester, Lexington, and Arlington demonstrated resilience and strong buyer interest across Boston’s northwest suburbs. While the number of home sales softened slightly, property values remained stable or appreciated, and homes continued to sell efficiently thanks to limited inventory and steady demand. These towns remain highly desirable for both homeowners and investors seeking long-term stability and growth, and despite shifting interest rates and market conditions, they are well-positioned to maintain strong fundamentals and upward pricing momentum in the coming year.